Buying your first home is a very exciting time. Unfortunately, the current housing market means that house prices may feel out of reach for many first home buyers.

It is important to think outside of the box and speak with your advisors early to work out whether there is a way of achieving your dreams of home ownership. Your first home does not need to be your forever home and getting on the property ladder is an awesome step even if it is not in your ideal or conventional way.

KiwiSaver has been a helpful incentive to help people get on the property ladder since its inception in 2007. Most people are aware that they can use their KiwiSaver to contribute towards the deposit required for their first home. With current property prices the deposit is often not the only obstacle. Cost of living and incomes sufficient to service large mortgages are an increasing issue particularly with the rising interest rates.

Increasing the size of your deposit and income pool and owning your first home with others is a great way to overcome the hurdles. Purchasing a property with other people is a good option to get you on the property ladder. Shared ownership will mean that all owners are recorded on the title as the registered owners as tenants in common in separate shares. The shares do not necessarily have to be in equal portions. Under any joint ownership with other parties, it is essential that a property sharing agreement is entered into between all of the co-owners. An agreement of this nature records the terms of the purchase, who will pay for outgoings, repairs and maintenance, management of the property, who is responsible for repayment of the mortgage, what happens if one party fails to perform their obligations and an exit strategy, if one party wants to sell but the others don’t.

If shared ownership is not an option for you but you are short on your deposit or are trying to reduce the amount of bank borrowing required to complete the purchase, talk to your family to see if any of them are in a position to assist by either gift or loan. The banks prefer a gift but will commonly also accept an interest-free loan repayable on the sale of the property. Whichever option is available to you it is important to document the gift or loan appropriately to ensure that all parties are protected.

In all of the above scenarios it is important for all parties to obtain their own legal advice to ensure that they understand the risks involved in joint ownership, gifting or lending.

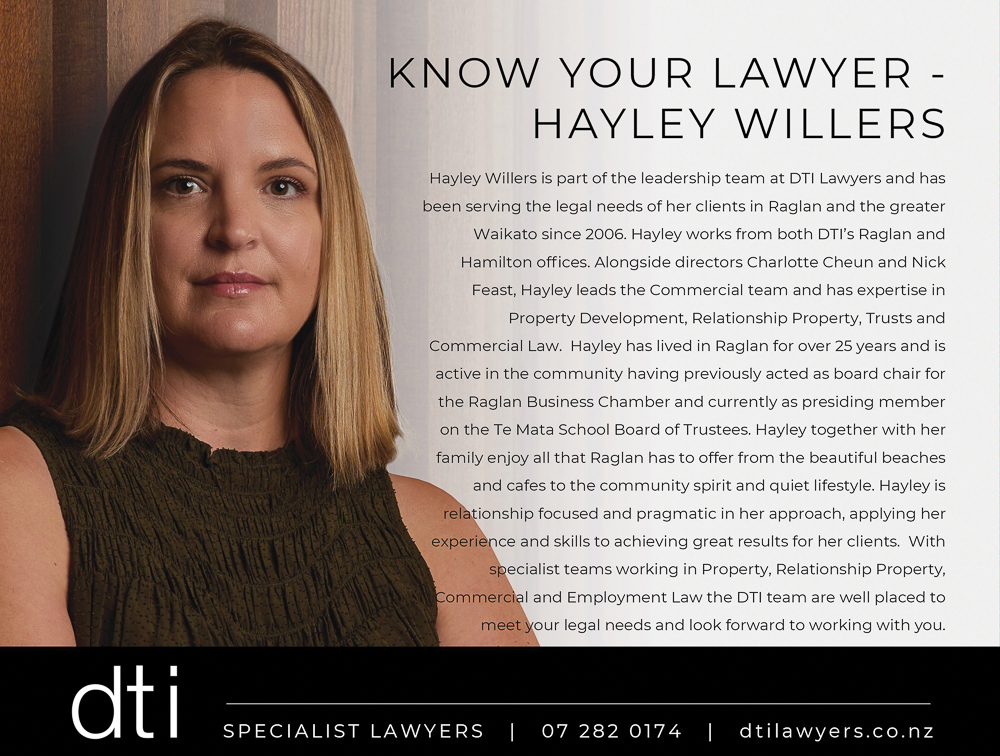

At DTI Lawyers we have a team of specialist property lawyers lead by director Hayley Willers. Our team can assist you with all of your property and asset planning matters.