Having over 5,000 clients around the country, every day we have multiple discussions with households and businesses reviewing their debt and advising on rate refixing. Over the last 18 months, the key theme of these reviews has been ‘how much more am I going to have to pay on my mortgage?’

A huge amount of money has been sucked out of the economy by higher interest rates. An extra $200 per week in mortgage interest has been common, sometimes a lot more. When a family pays $200/wk more on their mortgage, that’s $200 less they can spend at the shops. That’s $867 less per month.

We’ve been waiting for that to translate into bad economic statistics. It sounds strange, but bad economic news at this point in time is good news in a way. With the economy ‘crumbling’ as several economists have stated last week, this takes the demand for goods and services out of the economy which means that it’s much harder for businesses to raise prices (as people just won’t or can’t pay more).

In the last 10 days, the Performance of Services Index (PSI) which makes up around 70% of NZ’s GDP (Gross Domestic Product – a key measure of our economy) has come back at the worst level we’ve seen in the last 17 years, excepting the periods when we were in lockdown. The Manufacturing Index is similar.

Last week the Consumer Price Index (CPI or ‘Inflation’) came back at 3.3%. This is down from its high of 7.3% in June 2022. The Reserve Bank of NZ (RBNZ) is mandated to keep inflation between the 1- 3% range. Many commentators are now saying the inflation battle has been won and are calling for the Reserve Bank to decrease the Official Cash Rate (OCR) which is one of the key influences on interest rates.

With these things in mind, most economists (even the pessimistic ones) have brought forward their forecasts for OCR cuts, and most are picking the first cut of 0.25% for November, if not sooner, with 4 further cuts in 2025. Interest rates in the United States have quite an impact on fixed mortgage rates here in NZ (as the NZ banks borrow a lot of money from them to fund NZ fixed rate mortgages) and the US Federal Reserve is tipped to start cutting the US base rate soon.

The next interest rate decision you make on your mortgage is going to be an important one. Looking at break evens between different rates will give you some perspective and help you make a more educated decision, as will keeping abreast of financial news.

As always, feel free to get in touch or pop into the office on Bow Street to discuss your options.

PS: There’s never been a better time to buy local. If you’re considering purchasing something from Hamilton or online, see if there’s an option to purchase it in Raglan and support our local economy.

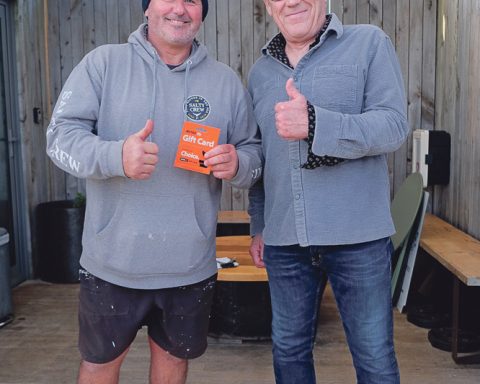

Mortgage advisor Brett Wood. Contact Brett on 021 886 444 email brett.wood@loanmarket.co.nz