Have you ever heard of an offset mortgage? If not, it’s a great way to reduce the amount of interest you pay on your mortgage by linking it to your savings and everyday accounts.

Here’s how it works: Let’s say you have a $500,000 mortgage and $50,000 across your savings and everyday accounts with one bank.

With an offset mortgage, the total sum of these savings and everyday accounts is deducted from your mortgage balance, so, in this scenario you’re only paying interest on $450,000 which reduces your monthly interest charges and goes a long way to paying your home loan off faster.

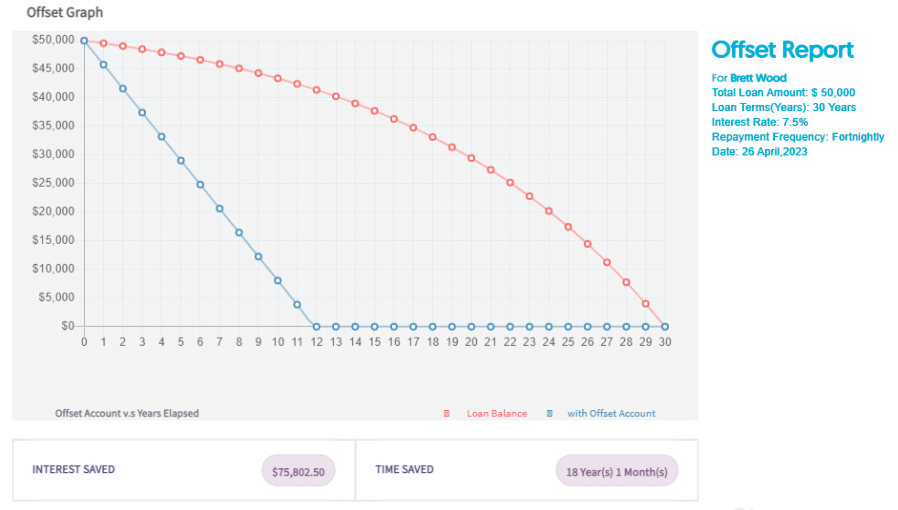

So, what does that look like in terms of actual dollar savings?

Using the scenario above, if you fixed the entire $500,000 mortgage for 1 year at 6.50% over a 30 year loan term the repayments would be around $3,160 per month.

But if we structured it to include an offset facility it would look something like this:

$450,000 fixed for 1 year @ 6.50% with payments at $2,844/m. Then a $50,000 offset facility on a floating rate at 7.50% which is linked to the $50,000 sitting in your savings and everyday accounts. Payments on this at $350/m. So total payments at $3,194/m.

The 7.50% floating rate on the $50,000 owing on the loan is offset by the money in your linked accounts; meaning that you pay no interest on that $50,000 loan provided you have $50,000 in your linked accounts. And that means that every dollar of the $350/m that you pay is paying down the principal.

The $350/m payment is based on a 30 year repayment period, but because you pay no interest thanks to the offsetting, you would pay off the loan in 12 years – even with the payment set at 30 years! This would save nearly $76,000 in interest charges compared to a normal loan repaid over 30 years.

You can really put your money to work by not only linking your own accounts but your children’s and even your parents accounts if they are with the same bank and if you ask them nicely.

They still have full access to their own accounts; all you are doing is using the current balances to reduce the amount of interest you have to pay.

So, if you tend to have savings on hand and keep cash in your accounts on a day to day basis you should definitely consider having an offset mortgage as part of your overall mortgage strategy.

You can use the funds to reduce the interest but have the reassurance that they are there for whenever you need them.

There are only three banks that currently have an offset mortgage product. If you are not currently with a bank that offers this product, then now would be the time to get you properly sorted with one that does so you can truly put your money to work for you.

Brett Wood

e: brett.wood@loanmarket.co.nz

p: 07 282 1650